Are FinTech startups actually disruptive to financial services? After two and a half years of making investments in the space, our observation is that most of the ventures in classic FinTech, or financial technology, categories, such as investing, lending, insurance and transactions, are sustaining innovationswhich will be copied or acquired by incumbents, rather than remaining independent and undermining incumbent financial services players’ profitability over the long term.

Disruptive ventures serve low-end or non-customers with a ‘reduced product’ at a price that is materially lower than the incumbent’s. By and large, it’s become clear that most classic FinTechs, particularly at the consumer level, in fact offer customers an optimised product or service and can rarely sustain a materially lower price than incumbents. In fact, the biggest threat to traditional financial services is a combination of commoditisation, caused by marketplaces and platforms that are disintermediating them from their end customers, and what you could call ‘disruption by outsourcing’.

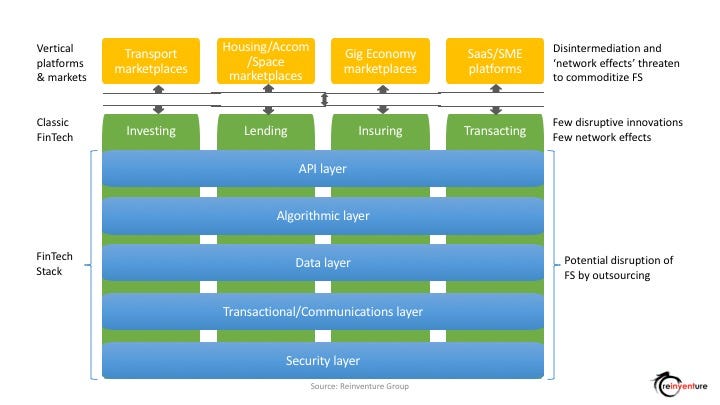

We’ve summarised the situation in the chart below:

Classic FinTech: Improving, not Reinventing, Financial Services

Digital balance sheet lenders such as On-Deck, Moula and Prospa make applications quicker and easier, and provide money faster. Personal financial management tools like MoneyBrilliant, Moven and Pocketbook improve the experience of banking for customers by giving them a view on how they are tracking financially, and providing financial guidance. Wealthfront, Stockspot, Clover and other robo-advisers improve the experience for investors and, while disruptive to financial planning salesforces, are a sustaining innovation for asset managers, improving their service and distribution for the low end of the market. Digital payments terminals like Square provide more functional and convenient terminals for merchants. Digital insurers similarly improve the experience and convenience of purchasing insurance.

Often, FinTech ventures are able to get a jump on incumbents because they are more consumer-centric and agile in building out these products. They can only achieve traction if they are highly focused on great customer experiences and take a lean/agile approach; disciplines that can be lost in large incumbents with too much capex and too many people involved in the innovation process. But this advantage is likely to be passing, as incumbents use their significant resources to buy the best people and get the product right in time. Moreover, such FinTechs have rarely had a sufficient intrinsic cost advantage that they can out-compete the incumbents in the long-term. For FinTechs in this territory, our advice is to stay close enough to the incumbents to know when they are making build/buy decisions, and ensuring they are well-positioned for acquisition.

There are a few areas where the structure of the business model is so fundamentally different that there may be a long-term cost advantage — ie peer-to-peer, or marketplace, lenders like Zopa, LendingClub, Prosper, FundingCircle and SocietyOne (disclaimer: a Reinventure portfolio company). Our bet is that marketplace lenders have an enduring place in the financial services eco-system, with the potential to disrupt traditional fractional reserve lending as a mechanism for matching borrowers and investors with corresponding risk, return and liquidity preferences. Even still, there is clearly a long road ahead to achieve this, as there is with all major disruptions.

The dark horses of Financial Services disruption

1. Commoditising by vertical marketplaces and platforms

What is likely to be more impactful to financial services incumbents is disintermediation by vertical marketplaces and platforms that have the ability to drive pricing down. Marketplaces like Uber and Airbnb, and platforms like Xero and Zenefits will have the ability to set pricing, effectively turning banks into utilities. The threat posed by such marketplaces is even more stark in China, where players such as Alibabahave gone beyond disintermediation, taking over the entire financial services stack using their own significant balance sheets.

2. Outsourcing the Stack

Alongside product commoditisation, there is also a process of ‘disruption by outsourcing’ going on in the financial services stack. The classic case study of disruption by outsourcing, originally articulated by the author of modern disruption theory, Clayton Christensen, is that of Dell and AsusTek. Originally, AsusTek manufactured motherboards for Dell, which it could do cheaper due to its low labour costs and economies of scale. Over time, it extended its way up the value chain, first by offering motherboard assembly, then complete computer assembly and, ultimately, direct shipping to the end customer. At each choice point, it made sense to Dell to outsource a particular layer to AsusTek due to their favourable economics. Over time, however, Dell became little more than a brand marketing machine, which Asus ultimately then replicated by taking on Dell as a direct competitor.

At each layer in the financial services stack, players are emerging to enable the outsourcing of aspects of the incumbents’ value chain and, increasingly, incumbents are taking those players up on that offer. Some layers have significant network effects which could in fact make the new player a price setter over time. This already includes players at the data layer, such credit reporting data from Equifax in the US and Veda in Australia. It also includes players at the API layer, such as Yodlee and Plaid with their suite of developer APIs. It could include players at the payments layer, though the banks have generally tried to ensure that such players are either jointly owned, such as SWIFT, or have relevant competitors, such as Visa and Mastercard, to ensure they don’t pay monopolistic prices. To date, the only threats in this space are various blockchains, which, as open source projects, don’t necessarily pose the same monopolistic threat as a centrally owned approach might.

These dark horses of FinTech disruption are therefore seemingly benign to incumbents at present, but may morph into threats over time as the financial services stack is further hollowed out.

Know your place in the stack

Of course, its often easier to see the dynamics of disruption, network effects and other economic dynamics in hindsight, and our thinking on this in relation to new businesses is always evolving. Nonetheless, it’s critical for ventures to have a view on their place in the stack, as this sets your growth trajectory and exit options. Disruptive opportunities can be a slow burn, and often require substantial capital over time to get there. Big network effect opportunities similarly require the capital to ensure you are number one in a winner-takes-all market. Sustaining innovations, on the other hand, are more likely to be sprints, so knowing when to exit and positioning for acquisition is critical.